A payments evolution is happening right before our eyes. We partnered with Payments Dive to conduct the 2022 Consumer Payments Survey, and we discovered that more of your customers are adopting digital payments.

And small businesses need to know: Consumers expect you to offer those digital payment options when it’s time to settle their bill.

We’re sharing our expert tips to help you boost productivity, eliminate time-wasting tasks, and more in this free guide.

Download Now

We sat down with Thryv’s Chief Product Officer, Ryan Cantor to understand the market shift and help small business owners make the shift to digital with their customers.

Digital Payments and Who’s Using Them

There are two types of digital payments consumers use: in-person and virtual. Both methods are contactless and use credit or debit card accounts, mobile wallets, clickable links for ACH payments, bank-to-bank transfers or payment apps.

It’s no surprise that younger generations like Millennials and Gen Z are leading the charge. In fact, 78-80% say they will continue using digital payments over cash and checks in the future.

The adoption of digital payments over cash and check for all generations is similar to how flip phones were treated after smartphones were invented — no one is going back to flip phones, Cantor explains.

What the study would suggest is that once consumers, of all ages really, adopt those convenient methods, they like them, and they don’t go back.

Not only is there a shift in payment preference, but in which generation has more buying power. According to the study, Millennials and Gen Z are expected to outspend Gen X and Baby Boomers in certain areas of their lives.

Balancing Traditional and Modern Payment Styles

Whether it’s a deposit for bathroom remodeling or an installment for legal fees, Cantor believes that paying a service-based business in cash or check creates apprehension. There’s comfort in using a credit card or contactless payment, especially if the dollar amount is substantial.

There is that minute you give someone a wad of cash where you’re having a little bit of a lump in your stomach. And you’re like: Well, I really hope this works out.

It boils down to convenience and safety. Most consumers feel safer and find it easier to pay for services digitally. If you force customers to use traditional payments, but your competitors offer contactless options, they will choose convenience and safety.

“It’s a consumer market,” Cantor says. “So, you have to find the happy medium of protecting your business, protecting your profitability, protecting your margins, but offering [customers] the convenience they want.”

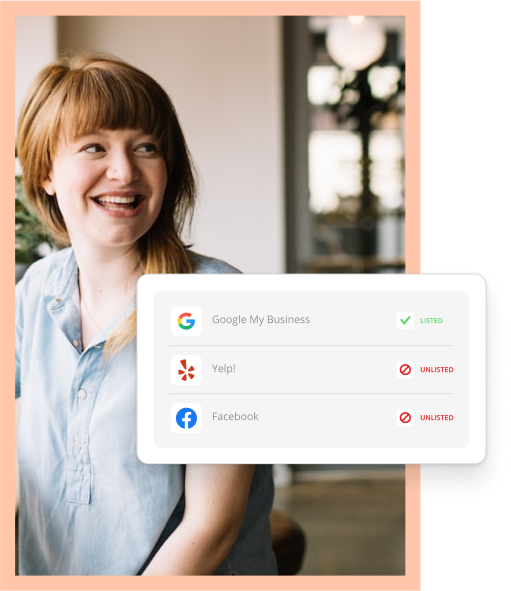

Adapting to Digital

The adage, “you can’t please everyone” doesn’t apply here. Small business owners must adapt to digital payments while still satisfying the needs of the few cash and check stalwarts. Luckily, we have tips on how to evolve your payment processor.

There are as many variables as there are payment processors, so the questions you should ask yourself when researching are:

- How fast do I get money and is there a fee associated to get it faster if I need to?

- Am I required to use hardware for payments, can I send a link, can I do both?

- What are the fee structures for each type of payment option?

Over 57% of customers are not willing to pay additional convenience fees when purchasing with a credit card.

Convenience fees are a challenging obstacle for small business owners and consumers because neither wants to be on the hook for a credit card processing fee. You can combat fees and give customers choices by ensuring you have affordable options, like ACH payments or bank-to-bank transfers.

It’s All About the Options

If you haven’t made the shift to adopting digital payments into your business model, now’s the time. And if your average ticket price is in the hundreds to thousands of dollars, then ThryvPay is the optimal way to get your feet wet.

Remember, options are the key and options are what consumers want. If you have options, you can guide customers to choose something more convenient and cost-effective for you and them.

For a deeper dive into the findings of Thryv’s 2022 Consumer Payments Survey, watch the full interview with Ryan Cantor below.