Do you know how much a dental practice costs? Recent increases in inflation, coupled with the possibility of a recession, can make managing dental business expenses as painful as a toothache.

Plus, your practice may already feel the negative effects of higher costs due to supply chain issues. At the same time, your clients may start holding back on spending as well, which could lead to reduced working capital and increased debt as you look for ways to stay current with creditors and suppliers.

Savings Calculator: Find out how much you can save.

Compare your existing payment solution to see how much you can save.

Try Now

One tactic to prepare for such possibilities is increasing cash on hand. Plus, keeping costs in check can go a long way toward that goal. Managing costs is important. But to do that, start with what’s typical in various categories for dental practice costs.

How much does a dental practice cost?

If you want to buy an existing dental practice, the average one costs about $520K. That estimation is based on 65% of the gross receipts from the business in the previous year. While these numbers can vary, the average dental practice generates about $800K in revenue, so 65% of $800K would be $520K.

The costs of opening a new dental practice are slightly different. Here’s what you can expect.

How much does it cost to open a dental practice?

The average cost of starting a new dental practice is typically a few hundred thousand dollars. The American Dental Association (ADA) provides a checklist of items you’ll need to secure for your business, like loans, building permits, and compliance forms that you can use to obtain a more accurate estimate.

If you’re looking for general statistics, we’ve pulled a list of dental practice overhead percentages in the section below.

Dental Practice Overhead Breakdown (Percentages)

According to the American Dental Association, industry benchmarks for dental practice management should be between 59% and 62% for your practice’s overhead costs. These include rent, utilities, payroll, supplies, lab fees, taxes, and insurance.

Let’s break it down further. According to Practice Financial Group, here are industry-standard ratios for the following expenses:

- Employee Expenses: Salary, payroll taxes and employee benefits should make up 24% to 28% of your overhead.

- Lab Fees/Supplies: Total lab fees and dental supplies should range between 10% and 14%, depending on the practice. For example, pediatric dentists may spend less on lab fees, while orthodontists might spend more on supplies.

- Rent: Rent as a percentage of overhead is difficult to determine, because real estate pricing relies on location and demand. Rent is a fixed cost and can make up a substantial portion of your overhead.

- Average Dental Practice Profit Margin: When determining if your dental practice is doing well, the profit margin should be a minimum of 40%, which is the average profitability of U.S. dental practices.

Average Dental Office Overhead

The average overhead for a dental office is approximately 62%. That calculation includes labor costs, supplies, rent, and other costs associated with managing a dental practice.

Are your costs higher than the averages above? Below are a few ways to manage business expenses for your dental practice this year.

Business Expense Management for Dental Office Overhead

Here are some key areas where dental managers could reduce costs in dental practices.

1. Shop around for new suppliers.

If you’ve been working with the same suppliers for a while, it may feel uncomfortable to find someone new, but it’s important to find supplies at the best price. In addition, having more than one supplier to turn to could be crucial if supply chain issues don’t improve or even get worse.

2. Find new lab partners.

Again, it’s important to shop around for new lab partners that could provide the services you need at a lower price. In addition to talking with new labs, talk with your existing lab to see if you could renegotiate your existing contracts to reduce costs. Ask about itemized services. You may find some labs offer better pricing for specific services versus their competitors.

3. Technology can lower employee expenses.

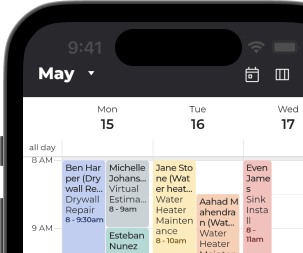

Using technology such as a customer relationship management software (CRM) and marketing automation software to automate tasks can go a long way in reducing employee expenses. Examples of tasks that can be automated include appointment scheduling, invoicing, email marketing, online reputation management and running social media channels.

4. Refinance or pay off debt.

Reducing or eliminating debt goes a long way in building up your working capital as well as serving as a key tool to lower costs in a dental practice. If possible, pay off any smaller debts to get them off the books. For any long-term loans, shop around with various lenders to see if you can refinance those loans at a lower interest rate.

5. Negotiate your rent.

During recessions, businesses are more likely to downsize or go out of business. This means that landlords are bracing for lower occupancy rates, late or even no payments, and economic insecurity. As a renter, your ability to offer security to your landlord may be even more valuable than how much you pay in rent. You may be able to negotiate a lower rent in exchange for a longer term on your lease.

Make the Cuts

Reducing costs remains essential to maintaining a successful dental practice. The first step is evaluating all current dental practice costs to see where reductions could be made.

Next, it’s important to review all available tools to see how they could further lower costs in your dental practice. These range from finding new suppliers to incorporating new technology to refinancing existing debt.

Looking for ways to reduce costs in a dental practice may seem difficult at first. However, once you evaluate those costs, finding ways to lower them may be easier than doing an implant.

It just takes some time and consideration to find the right path for making the most of the money in your dental practice management.

The Guide to Running an Efficient Small Business

Eliminate time-wasting tasks and get back to business.